Overview

Pantera Capital report talks recession and crypto.

Bitcoin has been in an oversold range for a record four weeks

Did Micheal Saylor purchase more Bitcoin?

Arbitrum Odyssey HALTED!

Grayscale ETF rejection promotes a court appeal.

Good morning Banter Fam,

The CEO of Panter Capital, Dan Morehead, just released the monthly Blockchain Report covering macro-economic factors and crypto. And wow, it has some insightful and bold takes regarding the current state of markets.

Yes, the same Dan Morehead on the alpha-packed Banter Show last Friday!

For some insight, Pantera Capital is one of the largest Venture Capital firms in the industry that began investing in crypto in 2013, profiting from a powerful trend long before many institutions. Their current balance sheet contains more than 100 various early-stage crypto projects. You may recognize a few (or a lot). These guys have been around a long time. Their CEO, Dan Morehead, has more than 35 years of investment experience. So when they speak, we listen.

So today, I'll summarize the latest report that covers the Fed's policy errors and some predictions regarding the great Fed "unwind." Additionally it makes some bold predictions for the future of crypto!

Summary of Pantera Capital’s Blockchain letter “The Fed’s Twin Policy Errors.”

The report starts by stating Dan Morehead's opinion that the Federal Reserve (Fed) committed two of the worst policy errors in 35 years.

Error 1: Keeping rate too low for too long. They are slowly correcting it.

Error 2: The more destructive decision is manipulating the bond market. In 95 years of their history, they never touched interest rates past the overnight rates.

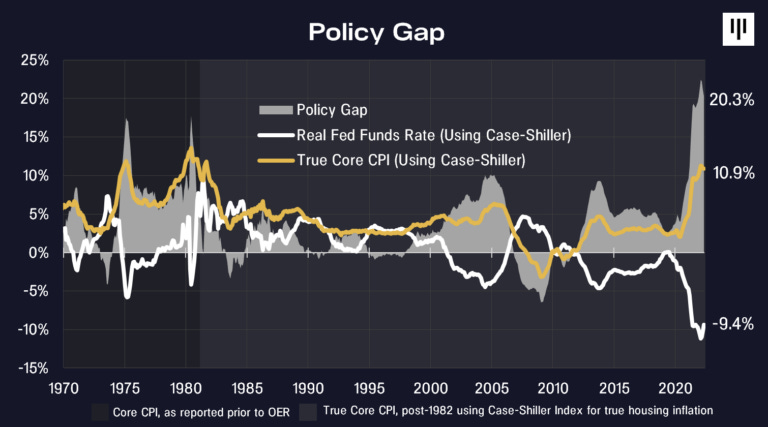

According to the report, inflation is at ridiculous levels compared to Fed Fund Rates. The highest since 1975. Highlighted in the chart below.

The Fed has insured one of the largest Ponzi schemes in history by manipulating government and mortgage bonds. First, inducing an enormous housing bubble that's taken 2.5m actors out of the labor market. Next, $2.9 trillion went into buying homes in 2020-21 before they pumped $6 trillion into mortgage and bond markets. The market has finally forced some discipline with a high Core Inflation Index (CPI).

“The bond market is now experiencing a Wiley E. Coyote moment.”

Dan Morehead

The report expects 10-year interest rates to quadruple from 1.34% to something like 5%. And the Fed is still buying mortgages! They need to SELL.

The Fed's actions were a massive win for homeowners and speculators, and the rest of the country is feeling the hangover. Home prices are up 38% in two years. However, Dan is concerned the Fed has no clue what is causing inflation (housing market), and the damage will continue until the Fed unwinds its manipulation in the bond market.

The report insists the inflation will continue to be persistent not because of supply shortages or Putin's war but rather a booming housing market and labor shortage.

“What I believe is that the Fed won’t stop raising rates until at least two of these happen:

Housing inflation goes negative

Unemployment rate goes up two percentage points

Core CPI gets near 2.5%. With owners' equivalent rent taking about two years to fully play out, that's probably at least a year away.

The Fed has unwound the majority of its mortgage manipulation."

- Dan Morehead

The Fed let everyone get drunk off the punchbowl before trying to remove it. Its job was to remove it before people got drunk. And now they are running a "Kabuki Theater" that will continue the cumulative damage until they "catch up to reality."

On the Grayscale GBTC trust.

The GBTC discount can continue to go negative, which the report predicts a couple more months of washout.

The Fed won’t approve the Spot Bitcoin ETF anytime soon.

On Crypto Decoupling from stocks.

Stocks, housing, and other assets are highly correlated to bonds' effects but have no direct connection to gold and commodities.

“ It's likely that digital gold (Bitcoin) can decouple and trade with things like gold. In the first rising rate environment in 42 years, there will be a rush to invest into things that don’t go down as the Fed unwinds its mistakes.”

Institutions are net crypto buyers and typically subscribe to 10-year funds that will continue to increase, buoying the crypto markets.

“Over the next six to nine months, I think valuations will come off in the private markets. And that is literally the best time to invest.”

My Takeaways

The Fed induced the plethora of the problems it's facing, and the housing/ bond bubble will take a long time to unwind.

Inflation will persist

Crypto “could” decouple from assets associated with bonds such as commodities like gold and oil.

Wait 6-9 months before investing in private markets.

“The four major blockchains that we’re excited about are Ethereum, Polkadot, Solana, and NEAR. The important point is that the vast majority of interesting tokens out there aren’t cryptocurrencies—they’re like crypto companies that are replacing traditional companies. There are more than 4,000 publicly traded companies in the U.S. We could easily have more than 4,000 tokens.”

Dan Morehead at Barron's first-ever crypto roundtable.

Market update 🌍

BTC/USD

Bitcoin is in familiar territory. The price is testing the 20k highs of 2017 once again. The weekly chart shows a Relative Strength Index (RSI) that has been in oversold territory for four weeks, something it hadn't done since 2011 when the price was around $3.00. The bad part is it can still go further down. Considering the major support levels, a large number of recent liquidations and a majority of indicators bottoming out, Dollar-Cost Averaging (DCA) should be under consideration for long-term investors. BTC completed yesterday’s session down -0.83% to US$20,098.

High-resolution chart

Newswatch 📰

Look who’s back buying Bitcoin! MicroStrategy has purchased an additional 480 bitcoins for ~$10.0m at the average price of ~$20,817. The firm, run by Micheal Saylor, now holds 129,699 bitcoins at an average price of ~$30,664.

Arbitrum Odyssey halt. The Arbitrum team has halted the Arbitrum Odyssey program concerning the high congestion on the network and will resume after the Nitro update is released. This news is a little disappointing considering how much fun we had on Arbitrum, but it seems too many people were in the same boat. The Arbitrum team plans to release a timeline shortly.

SEC rejects Grayscale Bitcoin ETF; Grayscale promptly sues. The Securities and Exchange Commission has again rejected Grayscale's Bitcoin ETF application because of its "failure to demonstrate its design to prevent fraudulent and manipulative acts.". In reaction, the institutional investment firm filed a petition for review with the US Court of Appeals.

Is North Korea behind the Harmony bridge hack? According to Forbes, the North Korean state-sponsored Lazarus appears to be behind the recent Harmony One (ONE) Horizon bridge hack of $100m in funds. As a result, the Harmony team offers one last opportunity to return the funds and retain $10m.

News tidbits:

A court in the British Virgin Islands has ordered the liquidation of Three Arrows Capital

Polysign Inc raises $52m series C

OKX crypto exchange to increase staff by 30%.

At the protocol level ⛓

Frax Finance to buy back 20m protocol-owned FXS tokens. Proposal FIP-77 passed with a 99.67% vote to burn 20m FXS governance tokens. The move could hold implications for the future price of FXS. Frax Finance provides the world's first fractional algorithmic stablecoin (FRAX), partially backed by collateral.

Protocol level tidbits:

Maker governance is voting to invest $500m in US treasury bills.

Introducing QiDAO (MAI) V2.

Beefy Finance is now on Optimism (OP).

Ronin Bridge reopens.

Inter-blockchain Communication Protocol explained.

NFT & metaverse update 🐵

Chai launches NFTs on its mainnet weeks after rolling out the initial NFTo standard on testnet.

The Sandbox to now deploy LAND on Polygon (MATIC).

EBAY ventures further into metaverse and NFTs with three trademark applications.

My five cents….

Wow. What a jam-packed day of wild news.

Unfortunately for us, the Arbitrum Odyssey program was halted. We'll continue guidance once it resumes, but it does raise a few concerns over the future of Layer-twos. Still too early to tell if you ask me, though.

Surprisingly, Micheal Saylor is back buying bitcoin after many feared his firm was facing liquidation. No stopping this guy! I'm curious how he got the new funding?

Can Grayscale make some ground up with the courts concerning the spot-Bitcoin ETF?

O, and check this out-Terra’s USTC and LUNC are up +850% and +169% in the 48hrs.

The crazy times continue in the cryptoverse!

Thanks for reading!

Gabi

Follow me on Twitter for daily updates!

Disclaimer

All opinions expressed by the publisher, writers, and chartists should not be construed as financial advice and do not necessarily reflect the views of Crypto Banter. The publisher, writers, and chartists may hold positions in the tokens and assets discussed. Readers are encouraged to do their own research.