Overview

Anonymous targets the befallen.

Crypto asset transfers reach record levels.

Could this chart be signaling the breaking of demand by the Fed?

FTX looks to purchase another major exchange.

Anonymous targets the befallen.

Good Morning Banter Fam,

The plot has just thickened in the cryptoverse.

While the contagion effect post-Terra collapse continues to plague the market in its various forms, including ungraceful liquidations of 3AC, Blockfi, and Celsius (all had ties to Terra or Luna assets), others were tracking the actions of Terra members during the turbulent times.

Many questioned Terra's inner workings during the collapse, specifically Do Kwon. So much so that the vigilante hacker group known as Anonymous took notice. In turn, Anonymous now has its sites targeted at bringing Do Kwon and the Terra teams to justice. (video below). Honestly, I'd be shaking in my boots if I were Do Kwon.

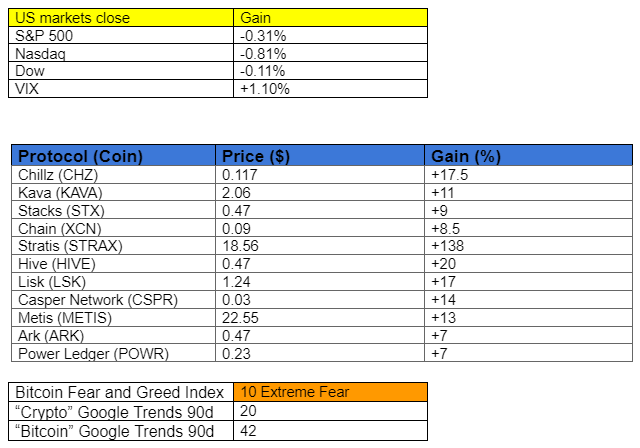

Market update 🌍

BTC/USD

In line with yesterday's newsletter, Bitcoin's (BTC) price appears to be losing steam as it neared strong resistance at the 22k levels. Additionally, the Relative Strength Index (RSI) has entered an oversold zone, all supporting a retracement in price. Unless some surprise factors appear this week, bitcoin will likely remain in a low volatility range between recent supports and resistances. BTC ended the US sessions down 1.56% to $20,699.

High-resolution chart

Moving from crypto and into macro, light crude oil future (CL1!) price appears to have broken a seven months uptrend in price and looks to retest the trend bottom. The goal of the Federal Reserve has been to reduce demand across the board; this trend breakage could be one of the first signals of a successful campaign. Although the supply side of Crude could hold significance in its price, it's beyond the scope of the newsletter to explore this aspect.

LIGHT CRUDE OIL Futures CL1!/USD

High-resolution chart

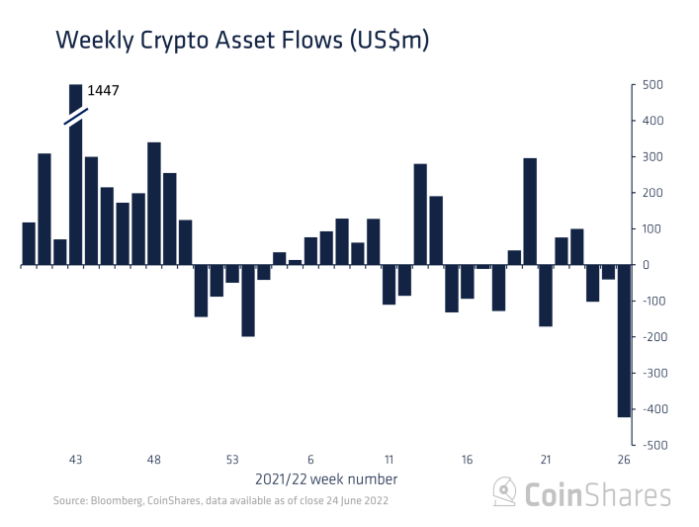

Digital Asset Fund Flows Weekly

The weekly Asset Funds Flows Report released by CoinShares shows a staggering number of outflows, totaling US$423m last week. The outflows mainly focused on Bitcoin, which saw a record total of US$453m. According to the report, the outflows were primarily from one Canadian exchange and may have been responsible for Bitcoin's decline to US$17,760.

On the other hand, Ethereum saw inflows of US$11m for the first time in11 weeks. The report focuses on institutional interest in crypto assets available on stock exchanges.

High-resolution chart

Newswatch 📰

Voyager comes after 3AC. Voyager Digital LLC has issued a notice of default to Three Arrows Capital for failure to make the required payments on BTC and USDC loans worth US$655m. Voyager intends to pursue recovery efforts, according to Cision Newswire.

Celsius team resists bankruptcy. The lawyers overseeing the Celsius insolvency issues have recommended the firm file for chapter 11 bankruptcy, but the team believes clients would prefer to avoid proceedings. Celsius believes avoiding a bankruptcy declaration will result in more value for clients while the firm unlocks illiquid positions. In addition, bankruptcies could enter Celsius into years-long proceedings, such as in the case of Mt. Gox, where users waited eight years to complete.

FTX to purchase Robinhood? Sam Bankman-Fried’s crypto exchange FTX is internally discussing a possible acquisition of stock/crypto exchange app Robin Hood. Earlier in the year, Sam Bankman-Fried purchased a 7.6% stake in the firm. FTX, alongside SBF, continues to expand while most of the industry struggles. SBF knows when he sees a good deal!

News tidbits:

Coinbase adds support for Chain (XCN), MetisDAO (METIS), Monavale (MONA), AirSwap (AST), and Media Network (MEDIA).

At the protocol level ⛓

Protocol Level Tidbits:

Totem wins the #20 Polkadot parachain auction supporting a slot for the KAPEX parachain.

Messari report on THORChain native THORswap (THOR).

NFT & metaverse update 🐵

NFTS tidbits:

Mars INC files crypto and metaverse trademark applications for M&M's.

My five cents…

If Anonymous is coming after you, you likely f*cked up somewhere along the way.

What are the chances Do Kwon escapes the grasp of Korean investigators, the Securities Exchange Commission, and now Anonymous?

I'd say I'd give it a 0.1% chance. Do Kwon will likely go to jail for his actions at Terra. People tend to take the dirty route when the incentive and the means are aligned. While millions of investors were losing their hard-earned money, these guys were likely filling their pockets along the way. I could be completely wrong, but I believe probabilities are in my favor. What's that famous line from Batman?

“ You either die the Hero or live long enough to see yourself become the villain.”

The Dark Knight

Good Luck, Do Kwon.

Thanks for reading!