Overview

Could the Fed be misleading us?

Markets: Seeking support.

Why is Michael Saylor being sued?

Arbitrum Nitro live! Wen Odyssey?

Macro is a big game.

Good morning Fam,

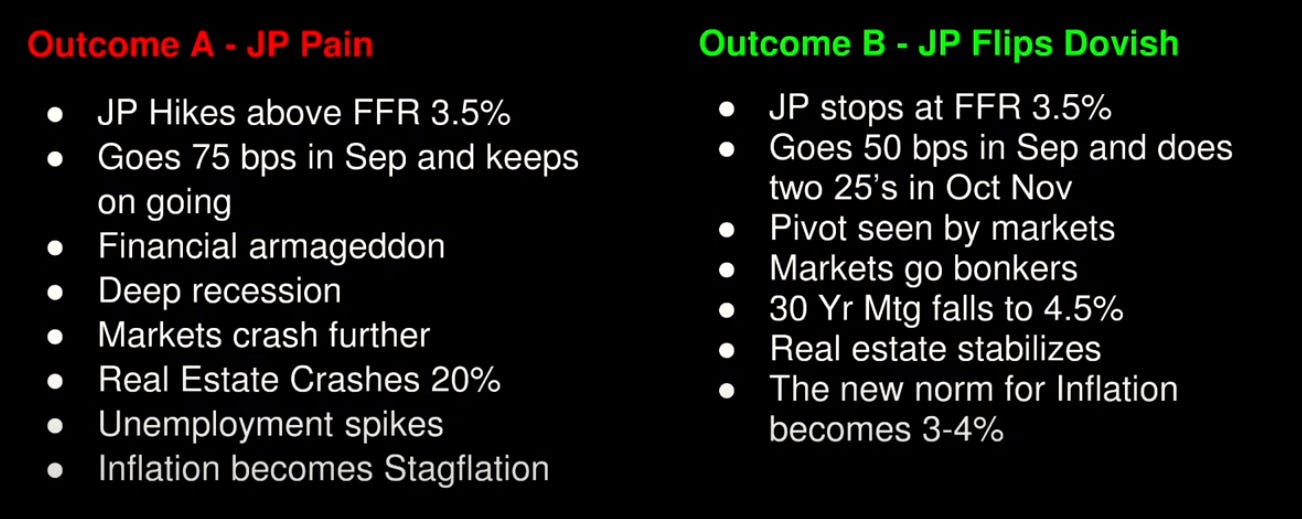

There is no denying the Fed has been highly hawkish, and the markets have suffered. But we should consider the possibility their stance is part of a strategy.

The Federal Reserve's head-fake.

Depending on who you ask, it seems the current path of the Federal Reserve leads to economic downfall. The economy and markets don't seem resilient enough to withstand the bombardment of hikes and QT the Fed has planned.

Isn't it odd how quickly they turned hawkish? Maybe the Fed knows this and is invoking a strategy of a loud hawkish voice upfront to set up for easing in the near future. Loud threats and a reactive market seem like a better option than a recession.

Many prominent investors believe the Fed can’t keep this pace. For example, Raoul Pal predicted an easing around September earlier in the year. Arthur Hayes predicted a return to USD printing to help Europe's bond situation. James of Invest Answers released a video yesterday that indicates the Fed accepts 3-4% inflation as the norm.

Source: Invest Answer YouTube

So who should you believe? The Federal Reserve that said inflation is "transitory" and promised a "soft landing." Or some very successful investors with proven track records and money on the line?

Market update 🌍

US equities continue to slide behind comments from Cleveland Fed President Loretta Mester's iteration of the Fed's focus on fighting inflation. She noted the Fed needs to raise rates above 4% and to leave it at an increased level until inflation begins to subside. Additionally, Mester forecasted inflation to fall to 5%-6% and sees the unemployment rate rising to 4% by year's end.

SPX/USD 1D

The S&P 500 (SPX) fell another 0.78% and nears a vital support zone of 3,900.00. With the Fed beginning quantitative tightening, next month and a high likelihood of a 75 basis-point hike, the market has little reason to pivot its bearish sentiment. Moreover, some important economic data is set to release tomorrow and Friday that could provide a change in attitude.

High-resolution chart

CL1!/USD 1D (Oil)

Raoul Pal tweeted his opinion regarding the price of oil yesterday and predicted the price falling to $60 or below. The decrease would help inflation (CPI) subside, ultimately bullish for the markets. Oil futures (CL1) might be an interesting chart for the coming weeks as it could be an early indicator of a successful inflation-reduction campaign by the Fed.

High-resolution chart

BTC/USDT 1D

Bitcoin remained flat today and appears ready to challenge the downtrend resistance (red) that began forming on Aug 15. I recommend keeping a close eye on the $19.3K support level. If the price falls below that level, there's no telling where the next bottom resides.

High-resolution chart

Newswatch 📰

Micheal Saylor sued for tax fraud. The Office of Attorney General for the District of Columbia is suing former MicroStrategy CEO Michael Saylor for tax evasion. The legislation comes regarding a civil complaint stating Saylor avoided over $25m in taxes by claiming residence in Virginia and Florida despite living in Washington, DC. Saylor responded to accusations by saying, " I respectfully disagree with the position of the District of Columbia and look forward to a fair resolution in courts."

BNB Chain introduces liquid staking. Binance has introduced liquid stacking with several protocols on the BNB blockchain, including Ankr, Stander, and pStake.

Arbitrum Nitro is live! The much-awaited L2 migration focused on scaling has been implemented. The update increases throughput and interoperability while reducing gas fees on the network, to name a few improvements. Best of all, this means the Arbitrum Odyssey program will likely resume in the coming days.

News tidbits:

President of Paraguay vetos crypto mining regulation law.

Ethereum miners horde a record number of Ether ahead of the merge.

16 South Koreans arrested for illicit foreign exchange violations.

NFT & metaverse update 🐵

Frida's art enters the metaverse. The Mexican artist’s family has released never before seen art in a permanent exhibition on Decentraland.

Solana NFT project Degods pumps ahead of its yoots NFT debut on Friday. The floor price for a DeGods sits at 587 SOL ($18,650).

A16z releases a set of free “Can’t Be Evil” NFT licenses to “serve three goals: (1) to help NFT creators protect (or release) their intellectual property (IP) rights; (2) to grant NFT holders a baseline of rights that are irrevocable, enforceable, and easy to understand; and (3) to help creators, holders, and their communities unleash the creative and economic potential of their projects with a clear understanding of the IP framework in which they can work.”

My Five Cents…

Macro is a big game.

Honestly, I've never been a macro guy until I landed this position as a newsletter writer. While the focus was primarily crypto-based content initially, the bearish market conditions forced many of us in the industry to begin covering macroeconomics.

After hundreds of hours of research and coverage, I've realized that macro plays out like a big game with all the characters and their unique roles: the government (Fed), professional investors, and the market. Of course, somewhere in there is the retail investor.

The ups and downs of the market are the completion of all these forces tugging, pushing, and pulling. Each is implementing its influence. The retail investor is in the middle of it all—a rider more than an influencer.

The most significant variable is the market. The players can influence it, but only sometimes. Most of the time, it's as unpredictable as the white whale in a Moby Dick novel.

Gabri

Follow me on Twitter for daily updates!